Asset Depreciation

| Platform: | WebMobile |

|---|---|

| Plan Type: | BasicEssentialPremiumEnterprise |

| User Type: | RequesterFull UserAdministrator |

Depreciation is a way of allocating the cost of an asset over its useful life. Calculating depreciation helps you track the gradual decline in an asset's value over time and manage your assets' financial lifecycle more effectively. You can:

- Evaluate the financial health of your assets.

- Make informed decisions about asset replacement and repair.

- Comply with accounting and tax reporting requirements.

MaintainX® uses the straight-line depreciation method, which allocates the cost of an asset evenly over its useful life. Straight-line depreciation assumes the asset loses value at a consistent rate each year.

Asset Depreciation Fields and Calculations

To calculate depreciation, you fill in some depreciation information when you create or edit an asset. MaintainX then calculates depreciation values and displays them in the asset details.

Information You Enter in the Asset Form

When you create a new asset, fill in the following fields in the Asset Depreciation section to give MaintainX the information it needs to calculate depreciation:

| Field | Description | Required? |

|---|---|---|

| Purchase Price | The original cost of the asset. | |

| Purchase Date | The date you purchased the asset. | |

| Useful Life (Years) | The number of years the asset is expected to be useful for. | |

| Salvage Value | The estimated residual value of the asset at the end of its useful life. Usually, a percentage of the purchase price. | |

| Depreciation Start Date | The date when depreciation begins. Usually, after the Purchase Date. If you leave this field blank, MaintainX® uses the Purchase Date in the depreciation calculation. |

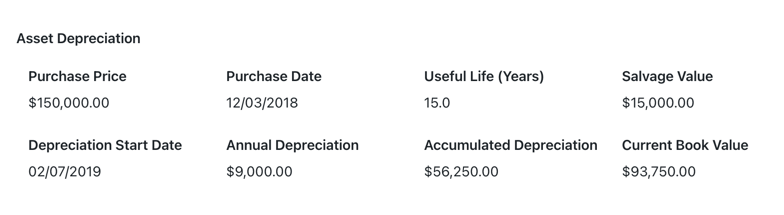

Depreciation Fields MaintainX Calculates

After you create an asset with depreciation information, MaintainX calculates depreciation, and adds the following fields to the asset details.

| Field | Description |

|---|---|

| Annual Depreciation | The yearly reduction in the asset's value, calculated based on the Purchase Price, Salvage Value, and Useful Life. Calculation: |

| Accumulated Depreciation | The total reduction in the asset's value from the Depreciation Start Date to the current month. Instead of using whole years, MaintainX uses fractional year depreciation, which is more accurate. Fractional years are calculated by converting the number of months between the Depreciation Start Date and the current date into a decimal. Calculations: Note An asset cannot depreciate beyond its Useful Life. If more years have passed than the useful life, the accumulated depreciation is capped. |

| Current Book Value | The asset's current value after accounting for depreciation. Calculation: |

How MaintainX Calculates Asset Depreciation

MaintainX uses the following sequence to calculate depreciation for an asset.

-

Calculate the Annual Depreciation:

Subtract the Salvage Value from the Purchase Price, then divide by the Useful Life.

-

Calculate the Fractional Years:

Determine the months that have passed since the Depreciation Start Date. Divide by 12 to get the fractional years.

-

Calculate the Accumulated Depreciation:

Multiply the Annual Depreciation by the Fractional Years to get the total depreciation accumulated as of the current date.

-

Calculate the Current Book Value:

Subtract the Accumulated Depreciation from the Purchase Price to get the current value of the asset.

Depreciation Calculation Examples

This section provides examples of depreciation calculations for the same asset—a CNC machine—given different starting information.

- Example 1

- Example 2

- Example 3

CNC Machine - Basic Example

This example shows a standard straight-line depreciation calculation for a CNC machine.

Asset Information:

This is the information the organization entered for the asset.

| Purchase Price | Salvage Value | Useful Life | Depreciation Start Date |

|---|---|---|---|

| $150,000 | $15,000 (10%) | 15 years | January 1, 2019 |

Calculations:

These are the depreciation calculations MaintainX performs.

| Value | Formula | Calculation |

|---|---|---|

| Annual Depreciation | ||

| Fractional Years | ||

| Accumulated Depreciation | ||

| Current Book Value |

Results (March 2025)

These are the results of the depreciation calculations that MaintainX adds to the asset details.

| Annual Depreciation | Accumulated Depreciation | Current Book Value |

|---|---|---|

| $9,000 | $55,500 | $94,500 |

CNC Machine - No Depreciation Start Date Example

In this example, the asset has no Depreciation Start Date, so MaintainX uses the asset's Purchase Date instead.

Asset Information:

This is the information the organization entered for the asset.

| Purchase Price | Salvage Value | Useful Life | Purchase Date |

|---|---|---|---|

| $150,000 | $15,000 (10%) | 15 years | June 15, 2018 |

Calculations:

These are the depreciation calculations MaintainX performs.

| Value | Formula | Calculation |

|---|---|---|

| Annual Depreciation | ||

| Fractional Years | ||

| Accumulated Depreciation | ||

| Current Book Value |

Results (March 2025)

These are the results of the depreciation calculations that MaintainX adds to the asset details.

| Annual Depreciation | Accumulated Depreciation | Current Book Value |

|---|---|---|

| $9,000 | $60,750 | $89,250 |

CNC Machine - No Salvage Value Example

In this example, the asset has no Salvage Value so the Annual Depreciation is higher, and the Current Book Value is lower than in example 2.

Asset Information:

This is the information the organization entered for the asset.

| Purchase Price | Salvage Value | Useful Life | Purchase Date |

|---|---|---|---|

| $150,000 | $0 | 15 years | June 15, 2018 |

Calculations:

These are the depreciation calculations MaintainX performs.

| Value | Formula | Calculation |

|---|---|---|

| Annual Depreciation | ||

| Fractional Years | ||

| Accumulated Depreciation | ||

| Current Book Value |

Results (March 2025)

These are the results of the depreciation calculations that MaintainX adds to the asset details.

| Annual Depreciation | Accumulated Depreciation | Current Book Value |

|---|---|---|

| $10,000 | $67,500 | $82,500 |